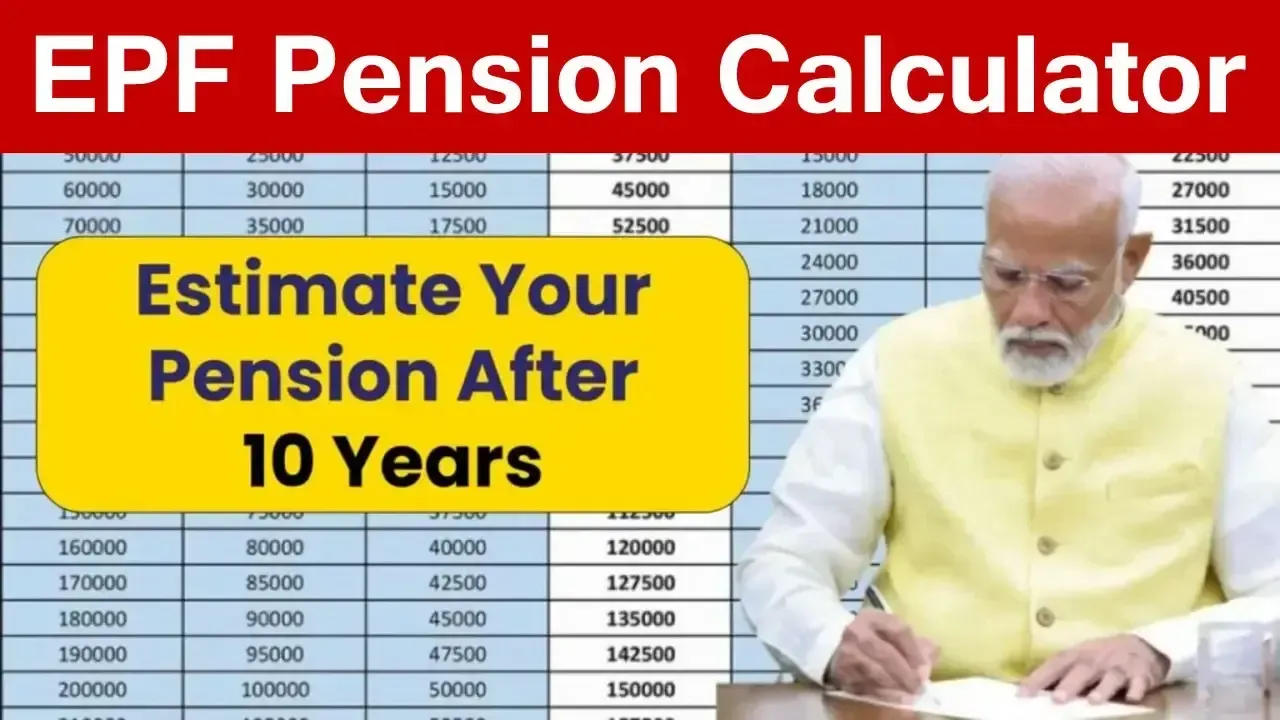

EPF Pension Calculator - What is the Formula to Calculate EPS Pension

EPF Pension Calculator, What is the Formula to Calculate EPS Pension, EPF pension Calculator for Private Employees - The Employees’ Pension Scheme (EPS), managed by the Employees' Provident Fund Organisation (EPFO), provides monthly pension benefits to eligible EPF members after retirement. Over the years, the EPFO has revised the pension calculation formula to better suit changes in wage structures and contribution ceilings.

In this post, we explain how the EPS pension is calculated, the formula used, examples for clarity, and how early retirement or opting for a higher pension affects the calculation.

EPS Pension Calculation Formula

The current formula to calculate monthly EPS pension is:

Pensionable Salary × Pensionable Service ÷ 70

1. Pensionable Salary

This is the average of the last 60 months (5 years) of basic salary before retirement.

Note: Before September 1, 2014, pensionable salary was calculated based on the last 12 months' average.

2. Pensionable Service

It refers to the total number of years the employee has contributed to the EPS scheme. If the service period includes time before and after the 2014 amendment, a pro-rata calculation applies.

EPS Pension Calculation Example

- Let’s assume:

- Joined EPS: January 2010

- Left service: February 2025

- Pensionable salary till August 2014: ₹6,500

- Pensionable salary after September 2014: ₹15,000

Calculation:

- For January 2010 – August 2014 (4 years 7 months, rounded to 5 years):

- ----- ₹6,500 × 5 / 70 = ₹464.28

- For September 2014 – February 2025 (10 years 5 months, rounded to 10 years):

- ----- ₹15,000 × 10 / 70 = ₹2,142.85

Total Monthly Pension = ₹464.28 + ₹2,142.85 = ₹2,607.13

EPS Amendment and Higher Pension Option

In 2014, the EPFO revised the wage ceiling from ₹6,500 to ₹15,000. Those who retired before September 1, 2014 will have their pension calculated using the old formula. Those retiring on or after September 1, 2014 will follow the new formula.

The EPFO also allowed eligible members to apply for a higher EPS pension until July 11, 2023. This option was only available to members who contributed on full salary (beyond the wage ceiling) and opted jointly with the employer.

Early Retirement under EPS

EPS allows early pension from age 50, but with a penalty:

- Reduction of 4% per year for every year the pension is drawn before the age of 58.

For example, if you opt for pension at age 55, the amount will be reduced by 12% (3 years × 4%).

Minimum and Maximum EPS Pension Amount

- Minimum Monthly Pension: ₹1,000

- Maximum Monthly Pension: ₹7,500 (if no contribution is made on wages above ₹15,000)

EPS Eligibility Criteria

To qualify for a monthly pension under EPS:

- You must have at least 10 years of contributory service.

- Service can be continuous or cumulative across multiple employers.

- Must be part of the EPF & EPS after November 16, 1995.

- From September 2014, only those with a basic salary ≤ ₹15,000/month are automatically eligible for EPS.

EPS Contributions – How Much is Contributed?

Only the employer contributes towards EPS:

- 8.33% of ₹15,000 = ₹1,250 per month (since Sept 1, 2014)

- No contribution is deducted from the employee’s share for EPS.

Less than 10 Years of Service? Lump Sum Withdrawal

If you leave the EPS scheme before completing 10 years of service, you're not eligible for a monthly pension. Instead, you can withdraw the pension amount as a lump sum.

Conclusion - EPF Pension Calculator

The EPS pension provides essential post-retirement financial support. Understanding how your pension is calculated—whether under the old or revised formula—can help you plan your retirement better. Whether you're opting for an early pension or higher pension, ensure you're aware of your service history, contribution amounts, and applicable rules.

If you’re nearing retirement, consult with EPFO or a qualified advisor to ensure all contributions are accounted for and that you’ve applied correctly for pension benefits.